Unlock Editor’s Digest for free

FT editor Roula Khalaf selects her favorite stories in this weekly newsletter.

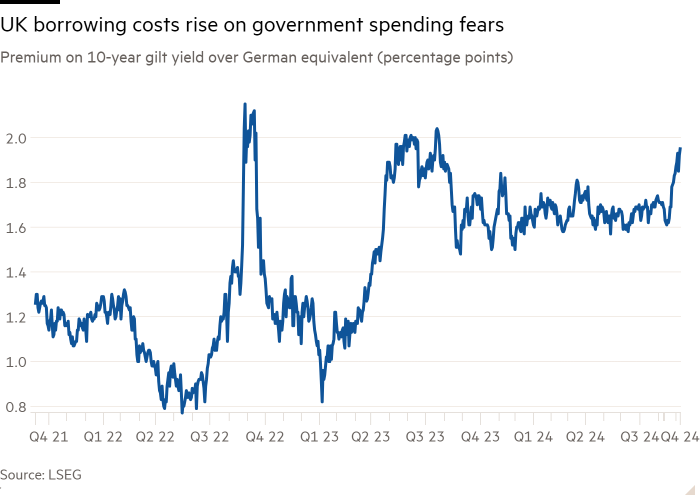

Long-term UK borrowing costs rose sharply, fueled by investor concerns about the Labor government’s budget, pushing the gap with Germany to the widest in more than a year.

With three weeks to go until Rachel Reeves’ first Budget, bondholders say the UK chancellor will have to walk a “tight rope” if he is to press ahead with his borrowing and investment plans without triggering a gilt-off sell-off.

The spread between benchmark 10-year UK and German bond yields has already widened to 1.94 percentage points, the biggest since August 2023, on worries that Reeves will increase debt as well as concerns about lingering inflation, say the investors.

“Financial markets will not allow much room for additional borrowing,” said Mark Dowding, chief investment officer at RBC BlueBay Asset Management.

“Rachel Reeves must walk a tightrope or the gold market will limit her ability to deliver much of Labour’s agenda.”

The 10-year gold yield rose to 4.2% on Tuesday from 3.75% in mid-September amid reports that the chancellor plans to relax lending rules to fund increased investment in the Oct. 30 budget.

Dowding added that the memory of the “mini-budget” of 2022, when former prime minister Liz Truss’s unfunded borrowing plans caused panic in the bond market, was still “etched into the psyche” of dollar investors.

Reeves is struggling to find tax increases to fill what she describes as a £22 billion hole in day-to-day government spending.

She scaled back plans to raise tax on non-doms despite a manifesto pledge and avoided hitting private equity staff with the top rate of 45p after the Treasury warned such measures could be counterproductive.

UK public borrowing has already exceeded forecasts this year, partly due to higher-than-expected spending, and some analysts expect the government will need to sell more gilts in the financial year to March 2025 than the current forecast of 278 billions of pounds.

The chancellor sought to reassure jittery investors, telling the Financial Times on Friday that he was not in a “race to get money out the door” and would put in place “buffers” to make sure public money is safe spend on sensible investments. .

Tomasz Wieladek, chief European economist at asset manager T Rowe Price, said such assurances were important to “give investors certainty about future gilt issuance” if the government changes its lending rules.

He added that the risk of higher-than-expected gold issuance in the coming years was a big factor in driving up UK borrowing costs.

Investors said the widening gap with German bond yields is also due to expectations that the European Central Bank will cut interest rates faster than the Bank of England to boost a sluggish euro zone economy.

The relatively weak performance of gilts was “a reflection of both [interest rate] political expectations and budget concerns,” said Emmanouil Karimalis, strategist at UBS.

However, BoE Governor Andrew Bailey said last week that UK rate-setters could be “a bit more aggressive” in cutting borrowing costs if inflation continued to fall.

While his comments supported short-term government debt, longer-dated gilts – usually more sensitive to government borrowing plans – continued to weaken.

Fiscal rule changes already discussed in the Treasury include reducing the impact of losses incurred on the BoE’s gilt portfolio and removing debt associated with investment vehicles such as Labour’s proposed GB Energy.

Reeves told the Labor party conference that he would end the “low investment that is fueling the decline” – widely seen as a sign that the government may also change the debt target to take more account of assets and liabilities the public sector.

The government’s move to rethink its fiscal framework won support from an influential think tank on Tuesday, as the Institute for Public Policy Research recommended scrapping the rule requiring public debt to fall between years four and five of the forecast.

It said Reeves would gain around £57 billion in “margin” – or the ability to borrow to invest – if it instead used a separate measure called “public sector net worth”, which incorporates a much wider range of assets.

The report argues that some of the additional margin should be retained as a buffer against an uncertain economic outlook.

The Treasury said: “The Chancellor said the Budget would be built on the rock of economic stability, including sound fiscal rules which were set out in the manifesto. These include moving the current budget into balance so that day-to-day costs are covered by revenue and debt falls as a share of the economy by the fifth year.”

#borrowing #costs #rise #chancellor #Rachel #Reeves #walks #tightrope #spending #plans