Indian investors are showing strong interest in generative AI startups, with funding growing massively in recent years. In the first half of 2024, total funding for GenAI startups in India reached $760 million, a significant increase from 2021.

In 2023 alone, AI startups in India raised $91.7 million, compared to $29.6 million in the same period the previous year. So far, Indian generative AI startups have secured over $590 million in private investment, with around 70% of the total funding to be raised in 2022.

Investor appetite is growing as fund managers pursue companies developing real-world AI use cases. Marquee investors like SoftBank and Antler are actively backing Indian AI startups.

In particular, there has been a shift in funding, with more capital now going to enterprise AI platforms as opposed to app-based startups compared to 2023. In the US, over 50% of funding in the first half of of 2024 went to the foundation. model startups.

Interestingly, Bengaluru stands out as the city with the highest concentration of generative AI startups in India. Additionally, nearly 84% of Indian CEOs are raising new capital or reallocating budgets to invest in generative AI, a figure that exceeds the global average of 70%.

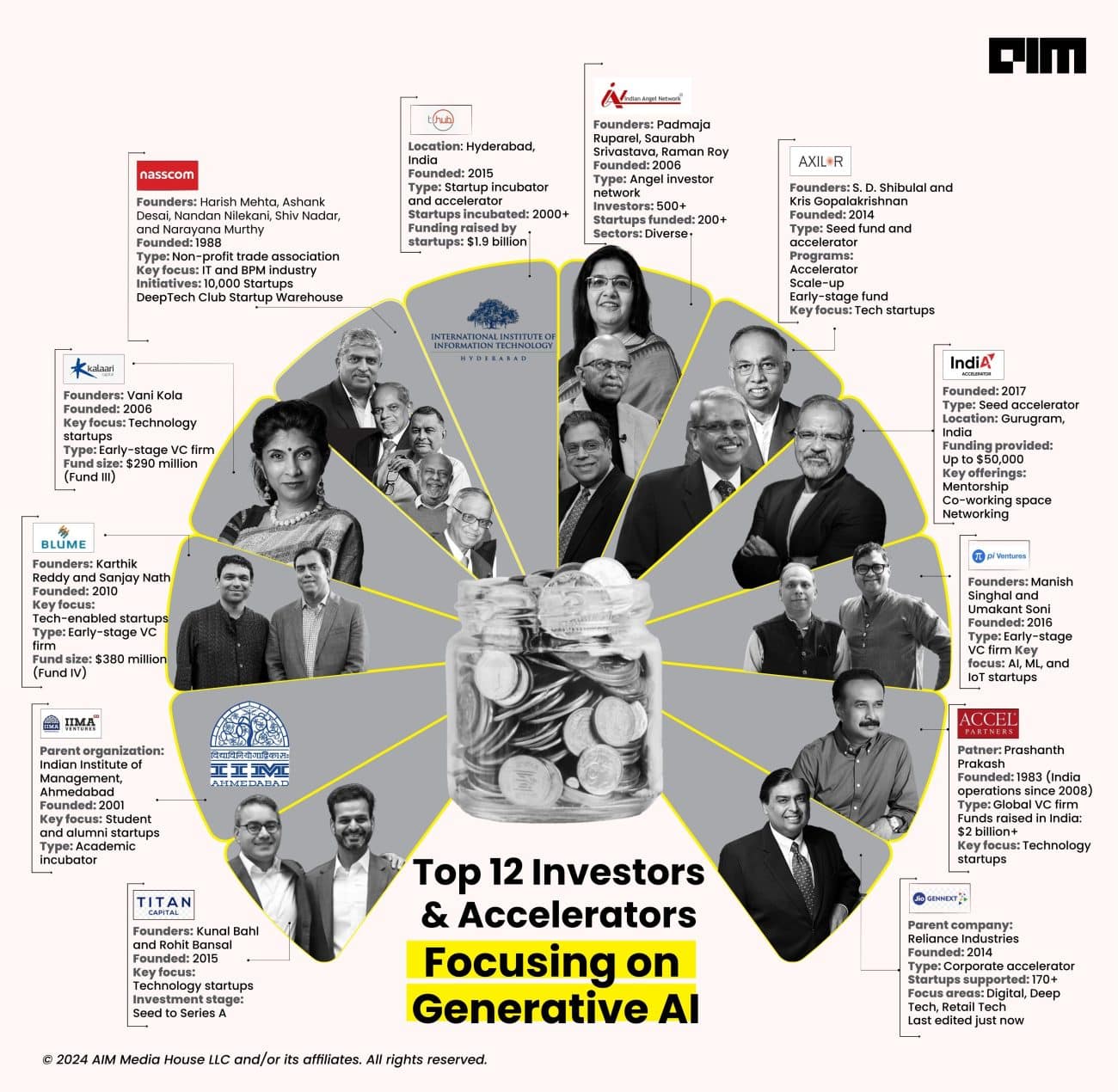

Here are some Indian investors and accelerators involved in the space.

Titan Capital

Based in India, it was founded in 2015 by Kunal Bahl, who is also the co-founder of Snapdeal. It focuses on providing capital to startups primarily in sectors such as SaaS and fintech.

The firm typically invests between $300,000 and $500,000 initially and has more than 300 investments. In 2023, they launched the “Winners Fund” to raise ₹300 million ($36 million) to support existing companies in subsequent funding rounds. This is its first external capital raising beyond the founders’ personal investments, allowing participation in larger Series A, B and C rounds.

They have now announced their program called “We are Funding”, providing entrepreneurs with partners who support them from day one.

IIMA Ventures

Located at IIM Ahmedabad, IIMA Ventures was founded in 2002. The initiative is supported by the Department of Science and Technology, Government of India and the Government of Gujarat.

The organization provides financial support through government grants and investments ranging from ₹10 lakh to ₹15 lakh (approximately US$12,000 to US$18,000) for enterprises, rising to US$5 million for more developed startups. It has funded over 350 startups and facilitated over 40 profitable exits.

It recently launched India’s first people and culture accelerator program to address the HR challenges faced by startups.

Blume Ventures

Blume Ventures is an India-based venture capital firm founded in 2010 by Karthik Reddy and Sanjay Nath. The firm primarily focuses on seed and pre-Series A investments in technology-led startups across sectors.

Having raised four funds to date, the latest, Fund IV, closes at over $250 million in 2022. This brings the firm’s total assets in AUM to over $600 million. The funds are designed to support startups that help challenges in India or use Indian innovation for global markets.

It has successfully backed over 60 startups in its first fund alone.

The capital of Kalaari

Kalaari Capital was founded in 2006 by Vani Kola. It initially started with a focus on investing in Indian startups. They mainly focus on startups in India and have been recognized for generating substantial returns for its investors and limited partners, who would earn over $600 million in 2021 alone from successful exits.

Located in Bengaluru, it actively participates in India’s startup ecosystem, investing in around 10-12 startups every year. The firm typically invests between $1 million and $10 million per startup, depending on the stage and potential of the company.

Founded in 1988, it was established by a group of entrepreneurs including NR Narayana Murthy, K Dinesh and SD Shroff among others. The organization was created to support and promote the growth of IT and BPO industry in India.

With over 3,000 member companies, including Indian IT firms and multinational corporations, the organization has played a vital role during crises, such as handling reputational challenges following the 2009 Satyam scandal.

In addition, it launched a program in 2013 to foster 10,000 startups in India by 2023, further underscoring its commitment to foster entrepreneurship.

T-Hub

Established in 2015, the world’s largest innovation campus is a collaboration between the Government of Telangana, IIT Hyderabad, ISB, NALSAR and industry partners like Tech Mahindra and Cyient.

Located in Hyderabad, T-Hub is a vibrant ecosystem that nurtures innovation and entrepreneurship. It can host around 1,000 startups, has a data center and centers of excellence from firms like Apollo Tyres, NPCI and others. It partnered with DST to establish MATH and NITI Aayog to establish AIC.

Since its inception, the firm has powered more than 2,000 startups through various initiatives, partnering with more than 80 angel investors and VCs to help raise nearly $2 billion in funding.

Indian Angel Network

Founded in 2006, IAN has actively invested in startups and provided funding and mentoring to early-stage companies, helping them scale up their operations and perfect their products.

It invests between $100,000 and $1 million in startups, averaging about $400,000 to $600,000 per investment. The network aims to exit investments within three to five years through strategic sales or other means. Regardless of sector, it has funded startups across 19 sectors in India and seven other countries, expanding the global footprint of its companies.

Axilor Ventures

An early stage venture capital firm based in Bangalore, it was founded in 2014 by Ganapathy Venugopal, SD Shibulal, Senapathy Gopalakrishnan, Srinath Batni and Tarun Khanna.

It typically invests in seed and startups, with round sizes ranging from $1 million to $5 million. The firm aims to be one of the top three investors in a startup’s seed rounds, participating alongside other investors such as Binny Bansal, Sachin Bansal and Pi Ventures. With about seven to 12 investments per year, it has a higher than average exit rate compared to other venture capital firms.

In 2022, Axilor announced the launch of its second fund with a corpus of 100 million dollars (770 million lei), building on the success of its first fund of 200 million lei.

Accelerator in India

Founded in 2017 by Ashish Bhatia, it is an India-based startup accelerator that supports startups focusing on generative AI, particularly in sectors such as content creation, automated workflows and data generation.

It invests up to $500,000 in seed capital through its SEBI-registered FIAs for startups that are part of its accelerator program and typically takes a 5-15% stake in the startups it invests in.

The accelerator has supported more than 100 startups since its inception, many of which have gone on to raise follow-on funding from prominent investors.

Pi Ventures

Manish Singhal is the founder of Pi Ventures and is dedicated to startups working on investing in technology-based startups, especially those working on AI and machine learning solutions. It provides mentorship, capital and connections to a global network of investors.

Fund I was launched with a corpus of USD 30 million and funded 15 companies and Fund II, launched in 2023 with a corpus of USD 85 million.

The firm also supports businesses that offer significant differentiation with the goal of creating value in both new and crowded markets. Its focus on “10x solutions” tackles big global problems through innovative technologies.

Accel Ventures

Global venture capital firm Accel has announced the launch of Accel Atoms 4.0, the fourth edition of its pre-seed scaling program, which offers selected startups up to $1 million, along with over $5 million in benefits from to their partners. Building on the success of three previous editions, this initiative aims to facilitate a seamless journey for visionary AI founders and entrepreneurs in Bharat, according to the VC firm.

Accel Atoms 4.0 invites applications from two categories of pre-seed startups: those focused on ‘Bharat’ and AI. AI-focused startups will be mentored in AI applications.

According to Prayank Swaroop, Accel partner and AI cohort leader, the program aims to support Indian-origin founders globally, focusing on AI solutions ranging from small language models to LLM-based systems.

JioGenNext

A startup accelerator program initiated by and sponsored by Reliance Industries Limited. They are actively engaging with tech start-ups through the JioGenNext MAP to help them scale.

Established nearly a decade ago, their partnership with MeitY Startup Hub provides access to RIL/Jio mentors, industry experts and investors; with notable startups.

Since its inception, they have run 18 startup mentorship programs, received over 13,670 applications and mentored 177 startups, helping them raise approximately $545 million in early-stage venture capital. In total, they supported 185 startups, with many graduates reaching significant funding and acquisition milestones.

#Top #Indian #Investors #Accelerators #Shaping #Future #GenAI