Take a closer look at Netflix’s potential here.

Innovative factors supporting Netflix

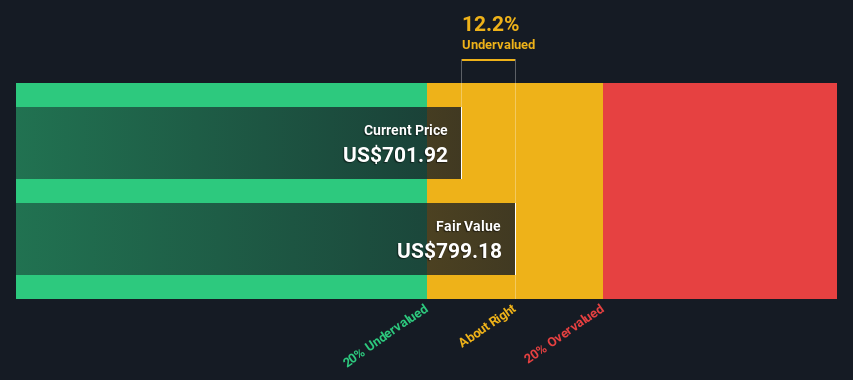

Netflix has demonstrated financial health with a significant focus on revenue and profit growth. The company reported a 67.1% increase in earnings over the past year, significantly outpacing the entertainment industry’s 3.8% growth. This performance is reflected in its high-quality earnings and improved net profit margins, now at 19.5% compared to 13.2% last year. The management team, with an average tenure of 4.5 years, and an experienced board of directors, with an average tenure of 11.2 years, contribute to stability and strategic execution. In addition, Netflix’s strategic alliances, such as partnering with Kingsmen Xperience to bring “Squid Game” to life, enhance its market position. Despite trading below its estimated fair value of $799.18, Netflix’s price-to-earnings ratio of 42.5x remains favorable compared to peers but is higher than the industry average.

Strategic gaps that could affect Netflix

While Netflix’s valuation compares favorably to peers, it is considered expensive relative to the US entertainment industry average. The company faces challenges in managing costs, with expenses down 7% year-to-date, expected to exceed $28 billion for the year. Ad revenue growth is also slower than anticipated, coming from a relatively small base. Additionally, Netflix’s debt-to-equity ratio of 63.2% highlights its reliance on higher-risk external borrowing. These factors, along with the absence of a dividend yield, can affect investor sentiment.

Potential strategies for leveraging growth and competitive advantage

Opportunities abound for Netflix, particularly in expanding its footprint in India and improving its advertising capabilities. The company’s revenue is expected to grow 10% annually, outpacing the 8.8% growth in the US market. Strategic initiatives such as integrating generative AI to improve recommendations and game designs are poised to drive engagement and revenue. Netflix’s recent production partnership with Pritish Nandy Communications for “The Royals” exemplifies its commitment to captivate global audiences, further strengthening its competitive edge.

Key risks and challenges that could affect Netflix’s success

Netflix faces intense competition in the entertainment sector, competing for viewers’ attention against numerous rivals. Economic factors and regulatory risks present additional challenges as advertisers demand more features. The company’s strategic focus on content spending, as co-CEO Ted Sarandos pointed out, underscores the need to outperform competitors in programming quality. These external pressures, along with the potential loss of paid sharing, pose significant threats to Netflix’s market share and growth trajectory.

To gain deeper insight into Netflix’s historical performance, explore our detailed analysis of past performance. To dive deeper into how Netflix’s valuation metrics shape its market position, check out our detailed Netflix Valuation analysis.

Conclusion

Netflix’s impressive financial performance, marked by a 67.1% increase in earnings and improved net profit margins, underscores its ability to outperform industry growth, reflecting the strategic stability of its experienced management and board. However, the company’s high price-to-earnings ratio of 42.5x, while more favorable than peers, suggests a premium to the broader US entertainment industry that may hurt investor sentiment. Strategic initiatives in international expansion and technology integration present significant growth opportunities, but rising costs and competitive pressures could challenge Netflix’s market share and profitability. Trading below its estimated fair value of $799.18, Netflix’s current market position suggests potential for appreciation, contingent on it effectively navigating its strategic gaps and capitalizing on its competitive strengths.

Next steps

Looking for other investments?

Valuation is complex, but we’re here to make it simple.

Find out if Netflix could be undervalued or overvalued with our detailed analysis, which includes fair value estimates, potential risks, dividends, insider trading and its financial condition.

Go to Free Analysis

Have feedback on this article? Worried about content? Contact us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St Analyst Simply Wall St and Simply Wall St have no positions in any of the companies listed. This article is general in nature. We only provide commentary based on historical data and analyst forecasts using an unbiased methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares and does not take into account your goals or your financial situation. We aim to provide you with focused long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or quality materials.

#Netflix #NasdaqGSNFLX #boosts #market #position #strategic #alliances #strong #financial #growth