Igor Omilaev via Unsplash.

Advertising is sometimes referred to as the canary in the economic coal mine, an early warning indicator of deteriorating or improving fiscal health.

Theory: If the economy turns bad, with ad spending down, then the general economy will follow.

Most common definition of recession it is a technical recession, after two consecutive quarters of negative real GDP growth.

By this definition, Australia hasn’t had a recession in 29 years.

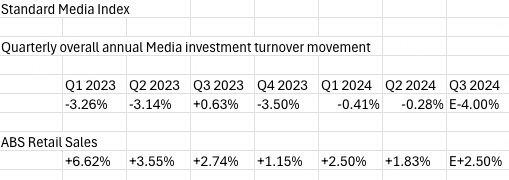

However, it’s a different story when it comes to advertising. According to the latest SMI numbers there have been seven consecutive months of decline this year.

In August, there was a 6.3% decrease in bookings at media agencies, July decreased by 7.8%, June decreased by 1.1%, May -5.3%, April -5.6%, March -6.6% and February -6%

But is an advertising recession a legitimate concept? Opinions are more complex and not completely negative.

While this period of decline is largely dictated by traditional channels (print, news and linear TV), it is coupled with growth in specific sectors (outdoor, search, social, digital video, digital audio and cinema) that may indicate resilience and potential areas. recovery in the advertising market.

The term recession is more indicative of declining investment in some advertising channels than the broader economic implications of a traditional recession, says Prophet’s chief data officer John Strumila.

“Historically, the advertising market is cyclical, often reflecting broader business cycles,” Strumila said.

“During economic downturns or periods of uncertainty, companies may reduce their advertising budgets as a cost-cutting measure. However, history also teaches us that the advertising market can, and usually does, bounce back.”

But anecdotally, industry media experts told AdNews they had never seen the sector in such decline and change in the past 12 months.

This could be the result of the economy stabilizing from the historic years of overspending during COVID.

Pearman Media director of strategy and research Steve Allen is not convinced there is a media recession.

“SMI’s first and second quarters are barely negative. In addition, SMI only covers about 40% of the total investment in the media market,” said Allen.

“Never does the SMI reflect global market dynamics to a great extent.”

Australia’s population has grown by 2.32% over the past year, but retail sales per capita have also fallen over the past 4 quarters, which could point to a retail recession along the same lines.

“In Australia, over the last 4 or 5 decades, there has been no correlation between the various characteristics of the Australian economy and media marketing spend,” Allen said.

“While it is generally true that strong retail sales (in an environment of low and consistent inflation) historically drive media marketing investment, the same is not true of weak retail sales; advertisers tend to pull back more in difficult trading conditions. Clearly, they become worried, cautious and conservative

“This dynamic we are witnessing now is a self-fulfilling slowdown in media advertising investment, but not an advertising recession!”

However, Schwartz Media chief executive Ben Shepherd agrees that the industry is in a slump.

“We’re approaching two years of macroeconomic downturns, so you could be even more bearish and call it a depression if it holds through to Q4. And that’s not even adjusted for inflation,” Shepherd said.

“Marketing science has shown that those who hold the line in bear markets see benefits once the pullback occurs.

“It’s a wait and see in terms of one — which advertisers have legitimately held the line, and two — whether the science will prove correct if/when we get out of the current cold conditions.”

For Next&Co’s head of strategy, Nick Grinberg, a strict definition is not relevant, but rather the acceptance of a “declining” market.

“Whether you call it recession or recession, you can see that the ‘output’ of our industry — in this case ad spending — has gone down,” Grinberg said.

“But mature advertisers have really shifted their focus to proving the effectiveness of their advertising. We see a sense that brands still want to run ads in the market – they’re just more concerned with efficiency.”

Perhaps the SMI is not the right data to determine an advertising recession

Ad markets by their nature are much more volatile than GDP and therefore larger swings are expected.

Magic head of growth Sarah Baskerville says business confidence is a more prominent and comparable driver of ad spend than GDP.

“Business confidence did however fall to -4% in August, the lowest point of the year so far, so we are probably feeling the impact of that,” Baskerville said.

“Normally I would heed the warning that the SMI is signaling here, however this is not a typical time window we go through so a wider context is needed before hitting the panic button and putting recession stake in the ground.

“The market came close to a year in which it racked up the second-highest ad spend on record. Despite its magnitude, 2023 was also down to the biggest year on record, driven by a post-Covid surge in ad spending due to excess savings, followed by a subsequent excess in consumer spending.

“Covid has distorted the market and we are still very much in a post-Covid era, so it is difficult to determine the basis from which to judge today’s performance.

“A normalization to pre-Covid levels was inevitable, so our annual spreadsheets are not so bleak when we look more holistically at the health of the market.

“Aussies have unprecedented bank savings and, in the face of rising inflation and high interest rates, we will see a reduction in consumer cash flow.

“As global economies flirt with recession and struggle with political turmoil, you could argue that the current climate is showing signs of strength to weather these historic years of excess spending.”

There is much to learn from the past

The industry has experienced a period of decline driven by the often harsh economic conditions of the Great Depression, World War II, the global financial crisis and COVID.

And what we historically see after is a strong rebound that would sustain for an extended period. So the industry remains hopeful.

“In the UK we saw some growth earlier this year (even if it was a dip when inflation was pulled out), which is promising,” Shepherd said.

In particular, the dot-com bust of the early ’00s and the global financial crisis of 2007/2008 can teach us many lessons right now, says Spinach GM and media director Ben Willee.

“The first lesson I learned is that it’s a bit like fighting a porcupine in a balloon factory – difficult, prickly and potentially catastrophic if not handled carefully,” Willee said.

“The key to wrestling is flexibility and training. The greatest danger is doing nothing.

“Keep your eye on the long game, be flexible and make sure you’re ready to take advantage of growth when it comes.”

Here’s how to stay agile, according to Willee:

Review your key performance metrics: Ditch the vanity metrics. Focus on what really drives your business. It’s not about how many likes you get, it’s about how many conversions you get.

Be flexible: Often, when the market is weak, advertisers hold back. However, good results are not just about retention. Consider making mid-term commitments to key channels. Media owners love to be in dedicated relationships with their clients and will offer a lot of benefits in return. These benefits include access to free activity, upgrades, integrations, and most importantly, low cost per thousand.

Negotiate with solid data: If you’re testing new media and approaches, there’s no better time to invest in attribution modeling. Now is the time to apply data-driven marketing. There are many methods to mathematically demonstrate the causal relationship between advertising, sales, and awareness. The cost of doing this is getting cheaper and it’s much easier to secure additional budget if you can qualify the likely impact of your media spend. Better yet, it’s a great way to protect yourself from the CFO looking for profit savings.

Supply chain transparency: I don’t want to talk outside the box, but we see huge amounts of waste in this area. Make sure every dollar spent is accounted for and delivers value. Transparency in your supply chain is more important than ever.

Look into some crystal balls: We know that Netflix, Amazon, and Disney will all be putting quality video inventory on the market in the back half of the year. All this extra supply will have an impact on the video price. Anticipate these changes and adjust your strategies accordingly.

Plan for growth: This is not the time to panic; it’s time to plan. Remember, all things that go down must go up. And as history has shown, periods of recession are often followed by periods of growth. Flexibility of the negotiation strategy is the key. Start thinking now about how you will respond when things turn around. The decisions you make now can have a long-term impact.

Do you have anything to say about it? Share your thoughts in the comments section below. Or, if you have a news or tip, drop us a line at adnews@yaffa.com.au

Sign up for the AdNews newsletter, like us on Facebook or follow us on Twitter for stories and disclosure campaigns throughout the day.

#Australia #facing #advertising #recession #AdNews