CHina’s latest stimulus measures are unlikely to trigger an increase in demand for iron ore imports and thus Capesizes. In its latest weekly report, shipbroker Intermodal said that “last week the PBC introduced a significant set of economic measures, marking the first time that a combination of rate cuts, reserve requirement reductions and structural monetary policies have been implemented together. The main purpose of these interventions is to address the ongoing real estate crisis, which has led to debt defaults among major real estate developers. Despite these efforts, the immediate impact on the freight market may be limited, as the crisis continues to stress the real estate sector, while the oversupply in the real estate market leaves little room for any significant construction activity in the near term.”

According to Intermodal’s Head of Research, Mr. Yiannis Parganas, “real estate has been central to China’s rapid economic growth, accounting for up to 20% of economic activity. However, this reliance has created significant risks. Before the pandemic, house prices rose much faster than household incomes. This environment encouraged developers to take on substantial debt, while land sales became a crucial source of revenue for local governments. This has led to oversupply in China’s real estate market, especially in lower-tier cities, which has created significant challenges. The government has considered buying large volumes of unsold housing as part of a comprehensive plan to alleviate the ongoing imbalance between supply and demand. This imbalance, along with weakening buyer sentiment caused by low income expectations and reduced spending, continues to weigh heavily on the market. The contraction in housing became more pronounced, with housing starts down more than 60% compared to pre-pandemic levels. While efforts to stabilize the market are underway, many developers remain financially stressed but have avoided bankruptcy, in part thanks to regulations that allow lenders to delay recognition of bad loans, which has cushioned the impact on property prices and stability the bank”.

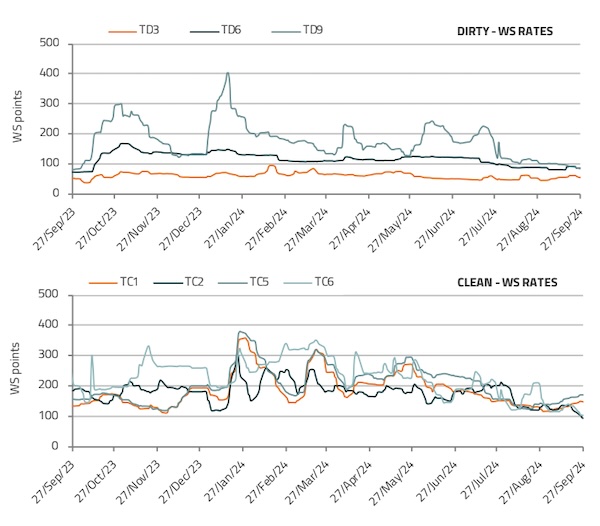

Source: Intermodal

According to Mr. Parganas, “in response to the increasing risks in the real estate sector, the Chinese authorities have redirected their efforts towards managing these risks and promoting a more balanced growth model. Since the outbreak of the pandemic, measures have been taken to reduce excessive lending among developers and to address systemic risks in the sector. As a result, real estate activity declined sharply, with policies now focused on expanding affordable housing, promoting rental units, and revitalizing underdeveloped urban areas. Today, as of August 2024, the latest data from the NBS indicated that the total area of unsold real estate in China reached 648 square meters, highlighting the severity of the oversupply problem. The actual number of vacant homes could be even higher, as many sold properties remain unfinished due to financial constraints.”

“Based on the points highlighted above, it can be concluded that even if the stimulus measures were to mark a turning point for the Chinese real estate sector in terms of stimulating buyer interest, a significant increase in demand for iron ore, which is closely related to the real estate sector, is unlikely. This is not only because the stimulus package is primarily focused on addressing the current oversupply of available space, but also because iron ore demand is already too robust to expect a positive correction. In fact, iron ore demand was considerably strong throughout 2024, with a year-over-year growth of 5.1%. This growth can be attributed to factors outside of the troubled real estate sector. First, stock levels, which hit a 7-year low in October 2023, have since been renewed to 150 million tonnes. Additionally, the weaker trend in iron ore prices since early July encouraged traders to continue importing. Domestic demand for steel was also supported by other sectors such as shipbuilding, the automotive industry and renewable energy projects. Steel exports have been particularly robust, with annual growth of 20.6% in the first eight months of 2024, and exports are on track to exceed 100 million tonnes, the highest volume since 2016. However, this increase in exports may prompt further anti-dumping investigations into Chinese steel exports, a development that requires close monitoring. The more pressing issue is that with Chinese steel mills operating at negative margins and global steel demand projected to decline, crude steel production is expected to decline, which in turn would reduce demand for ore iron on the sea. Without support from the domestic real estate sector, future iron ore trade volume could take a downward trajectory,” said the Intermodal analyst.

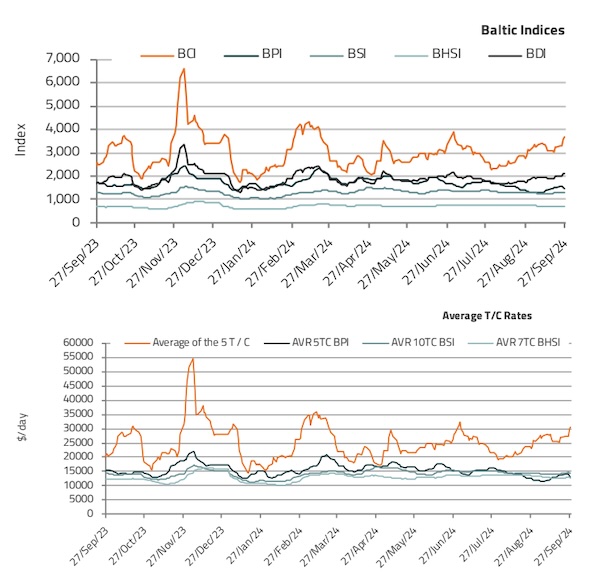

Source: Intermodal

He concluded that “despite the pessimistic outlook on the impact of the stimulus package on iron ore imports, such measures should only be seen as a positive signal for stronger consumer activity in China. These relief efforts have the potential to boost consumer confidence, which currently stands at 86 points, the second lowest level on record. Beyond real estate, the ripple effects of China’s demand contraction are being felt globally. Weak domestic spending affects various commodities, and in the case of the dry bulk market, grains are significantly affected. A sluggish livestock sector and ample supplies led to year-over-year declines in corn and soybean imports of 16 percent and 1.7 percent, respectively. As this season’s harvest progresses, U.S. corn exports remain weak, French barley shipments to China have fallen sharply, and Canadian exporters face significant challenges. The importance of the stimulus package in increasing the availability of consumer capital therefore becomes increasingly apparent as it could help alleviate these ongoing difficulties”.

Nikos Roussanoglou, Hellenic Shipping News worldwide

#Dry #bulk #market #Chinas #stimulus #increase #demand #commodity